Similar organisations to Mattituck-Laurel Civic Association Inc

-

Private Grantmaking Foundations

-

847.

Jw & Resource Floors Outreach for Humanity Inc

Impacting Lives One Community Service Project at a Time.

71

San Diego

-

Community Foundations

-

848.

Chesapeake Charities, Inc.

We are a community foundation, a tax-exempt public charity enabling people like you to establish charitable funds.

1000

Stevensville

Community Conscience

Community Conscience is a non-profit that owns and operates the Human Services Center.

606

Thousand Oaks

-

Environmental Quality Protection and Beautification N.E.C.

-

850.

Citizens Planning Committee Inc

CommunityServices Community Involvement Get Involved Mission.

Bishop

-

Community Mental Health Center

-

851.

Bonita House, Inc.

The mission of Bonita House, Inc. is: Building community, dignity, hope, and wellness with people recovering from mental health and substance use disorders.

Berkeley

-

Public Foundations

-

852.

National Air Traffic Controllers Association Charitable Foundation

National Air Traffic Controllers Association THE NATIONAL AIR TRAFFIC CONTROLLERS ASSOCIATION CHARITABLE FOUNDATION IS ORGANIZED FOR THE PURPOSE OF ASSISTING CHARITABLE EDUCATIONAL, SCIENTIFIC OR OTHER ACTIVITIES BENEFITING THE COMMON WELFARE.

12766

Washington

-

Public Foundations

-

853.

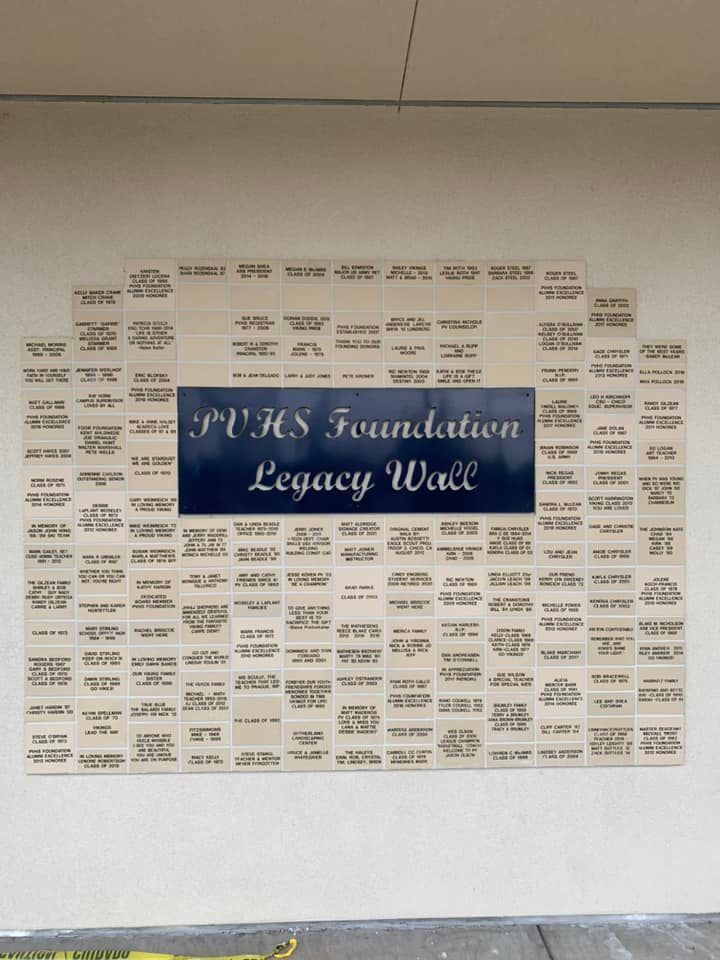

Pleasant Valley High School Foundation

Pleasant Valley High School Foundation funds grants and programs that allow PV students to achieve excellence in their academic, creative and social development The Pleasant Valley High School Foundation funds programs that allow PV students to achieve excellenc SUPPORT AND PROMOTE THE EDUCATIONAL AND EXTRA-CURRICULAR NEEDS OF STUDENTS AT PLEASANT VALLEY HIGH SCHOOL.

1263

Chico

CREATE FOUNDATION

Encouraging philanthropy and providing leadership to impact regional issues in Northeast Mississippi.

1896

TUPELO

-

Public Foundations

-

855.

THE FOUNDATION FOR NORTHWEST IL

Inspiring donors and empowering community partners for a stronger Northwest Illinois Donors Secure 25 Income Tax Credit with Endowment Gifts This law was passed in Spring 2024 and provides a 25 State of Illinois tax credit to donors who give to endowed funds at community foundations across Illinois who are in compliance with National Standards.

1169

FREEPORT