Neighborhood Trust Financial Partners

Nonprofit financial services innovator. Creating financial security for low wage workers through workplace and marketplace solutions. Home to @MyTrustPlus. Financial services innovator making financial security possible for all workers. Neighborhood Trust Financial Partners’ mission is to empower low-income individuals to become productive participants in the U.S. financial system and achieve their financial goals. We provide trusted financial guidance to workers, and connect them to safe and effective financial products that help reduce and avoid debt and address immediate financial challenges. Our worker solutions are primarily delivered through TrustPlus, our workplace financial health solution that is embedded nationwide within small businesses, large employers, fintechs, worker power organizations, and more. In addition, we advise credit unions and city governments on how to use our proprietary coaching model to help workers reduce and avoid debt and build financial health.

Founded

1996

176

X (Twitter)

758

Traffic

5055647

Financial security for all workers - Neighborhood Trust Financial Partners Visit Visit Neighborhood Trust is a financial services innovator creating financial security for lowwage workers. Nora and herFinancial Coach Nathalie Neighborhood Trust is a financial services innovator creating financial security for lowwage workers. Nora and her Financial Coach Nathalie Explore how were helping workers break free from debt cycles in Tackling Debt on All Sides. Explore how were helping workers break free from debt cycles in Tackling Debt on All Sides.

From Social media

News about from their social media (Facebook and X).

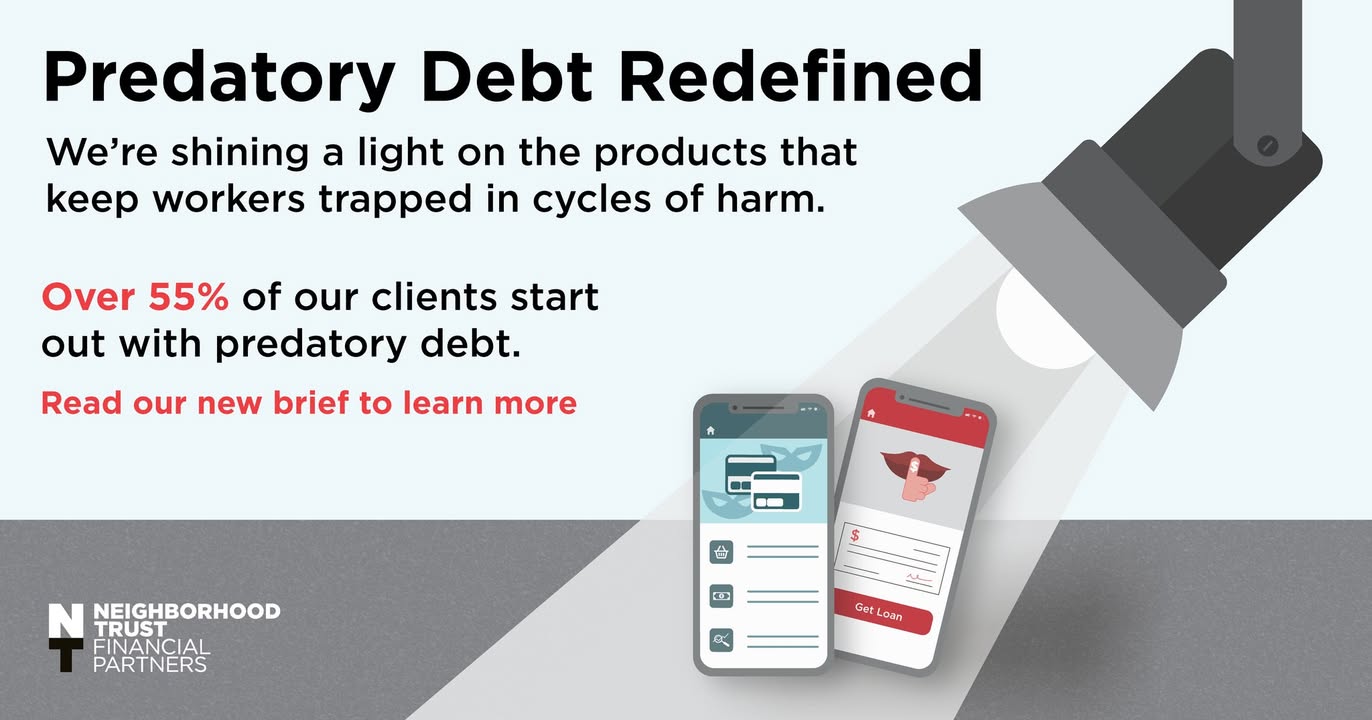

We’re proud to announce the launch of our new insights series on predatory debt, taking a bold step toward reshaping how harmful financial products are defined and addressed. Over the years, our work with low-income workers has given us a unique, in-depth perspective on the debt products that entangle them in cycles of borrowing and strip them of financial stability. Our data reveals that 55% of our clients are burdened by predatory debt, and 94% of those hold at least three harmful products.

Like Comment

Data about organisation

Economic Development Category

Organisations with similar rank to Neighborhood Trust Financial Partners in category Economic Development

EDUCATIONAL & ECONOMIC aid to girls & women living in the Kyangwali Refugee Camp & the DR Congo.

1268. Madison Seed Accelerator Inc

Madworks is a seed accelerator operating in Madison, WI that provides grants, mentors, guidance on governance, and structure to early-stage companies from Wisconsin.

1269. Neighborhood Trust Financial Partners

Financial services innovator making financial security possible for all workers.

Harrison House is a 501 c3 dedicated to the preservation and sharing of African-American history in Las Vegas and the promotion of neighborhood improvement.

Community/Neighborhood Development, Improvement Category

Organisations with similar rank to Neighborhood Trust Financial Partners in category Community/Neighborhood Development, Improvement

2495. WOMEN AND YOUTH SUPPORTING EACH OTHER

WYSE provides girls with resources and support to make empowered life decisions.

2496. Southeastern Vermont Community Action, Inc.

Our goal is to empower and partner with individuals and communities to alleviate the hardships of poverty, provide opportunities for thriving and eliminate the root causes of poverty in southeastern Vermont.

2497. Neighborhood Trust Financial Partners

Financial services innovator making financial security possible for all workers.

2498. HUSAYNIA ISLAMIC SOCIETY OF SEATTLE

The principal focus of Husaynia is to spread the call of Imam Husayn(as).

2499. Northwest Wisconsin Community Services Agency Inc

Equal Opportunity non-profit services to low-income residents across five Northwestern Wisconsin counties.

Financial Counseling, Money Management Category

Organisations with similar rank to Neighborhood Trust Financial Partners in category Financial Counseling, Money Management

157. Up From Slavery Initiative

Our mission is to heal, inform, and empower our underserved community through our many initiatives.

We strengthen families and individuals who seek to improve the quality of their lives.

159. Neighborhood Trust Financial Partners

Financial services innovator making financial security possible for all workers.

161. Financial Advocates of Southeast Idaho Inc

Comprehensive Agency for Mental Health & Medical Needs.

New York

Organisations from Neighborhood Trust Financial Partners

Xavier Mission is a non-profit organization addressing hunger, homelessness, and poverty.

2304. THE MEMORY PROJECT PRODUCTIONS INC

Creating positive change in the world through art, storytelling and education; memorializing victims.

2305. Neighborhood Trust Financial Partners

Financial services innovator making financial security possible for all workers.

2306. RETHINK THE CONVERSATION LTD

Rethink The Conversation creates programs that shift perspective, specifically around Mental Health.

Similar organisations

Similar organisations to Neighborhood Trust Financial Partners based on mission, location, activites.

Empower Communities.

Let's build a more just and vibrant society.

Consumer Credit Counseling Service of Delaware Valley

We empower Greater Philadelphians to achieve financial resilience.

Similar Organisations Worldwide

Organisations in the world similar to Neighborhood Trust Financial Partners.

Connect Community Plus Kids Inc (au)

Connect Kids is a broad based volunteer mentoring program designed to support vulnerable kids on the Sunshine Coast with the aim to end the cycle of inter-generational disadvantage in our communities.

Supporting Good Causes & Improving Connections in the Lending; Leasing; Asset Finance; Alternative Funding and Banking Arenas.

Interesting nearby

Interesting organisations close by to residence of Neighborhood Trust Financial Partners

THE OFFICIAL LPAC FB PAGE.

Neighborhood Trust Financial Partners

Financial services innovator making financial security possible for all workers.

Oldest remaining residence in Manhattan, built in 1765.

NORTHERN MANHATTAN IMPROVEMENT CORP

Our mission is to serve as a catalyst for positive change in the lives of the people in our community on their paths to secure and prosperous futures.

Similar social media (934)

Organisations with similar social media impact to Neighborhood Trust Financial Partners

170422. THE JEFFERSON FOUNDATION

Colorado's oldest, continuous, education foundation securing resources for Jeffco County Schools.

170423. Homeless Not Toothless

Homeless Not Toothless is now providing treatment at Dr.

170424. Neighborhood Trust Financial Partners

Financial services innovator making financial security possible for all workers.

170425. Longview Ministries Inc

Longview is a home missions ministry using the unique aspects of the camping ministry to reach young.

For agricultural professionals and rural homeowners, the Vermont Farm Show is the best opportunity to meet with vendors, preview products and machinery, attend trade association meetings, seminars and network within the greater agricultural community.

Similar traffic

Organisations with similar web traffic to Neighborhood Trust Financial Partners

1992. GULF COAST KIDS HOUSE INC

Gulf Coast Kid's House is a not-for-profit children's advocacy center serving child victims of abuse.

1993. Detectives Endowment Association Retirees Health Benefits Fund

The labor union proudly representing "The Greatest Detectives in the World.

1994. Neighborhood Trust Financial Partners

Financial services innovator making financial security possible for all workers.

FRS has been established to facilitate, encourage & support the dialogue and collaboration between clinicians, researchers and academicians around fasciae.

Join us and make a difference for the future!

Sign Up

Please fill in your information. Everything is free, we might contact you with updates (but cancel any time!)

Sign in with Google